Identity and Fraud Protection

MetLife and Aura offer an all-in-one digital security solution as an employee benefit. The AI-powered solution covers the broad spectrum of identity theft, financial fraud, and digital security for employees and their loved ones — all in one easy-to-use app. Employees can easily set up their Aura account and monitor protection through a personalized dashboard. Ongoing protection includes real-time threat alerts, notifications, and access to 24/7 U.S.-based customer support.

Note: Aura Identity and Fraud Protection is available to benefits eligible U.S.-based employees only.

Go to my.aura.com to register or Download overview of the set up process (PDF)

Key Benefits

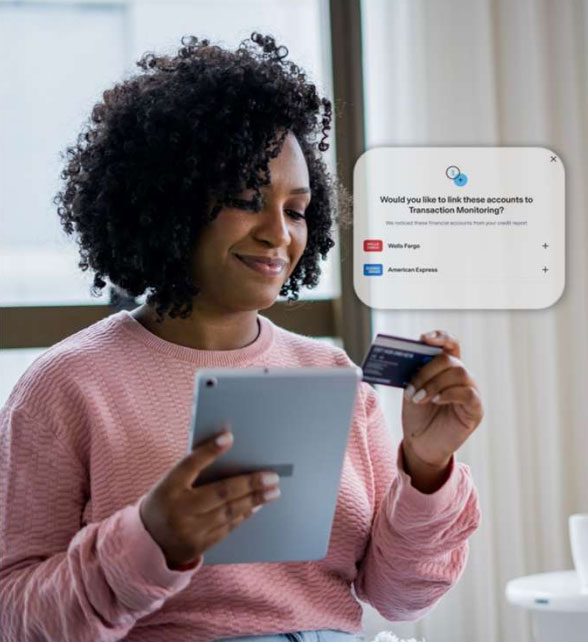

Financial Fraud Protection

- Real-time monitoring of credit, financial accounts, and asset titles, with alerts for suspicious activity.

- One-tap credit lock and financial tools to protect money and assets.

- Advanced financial transaction monitoring powered by AI to detect high-risk or unusual transactions.

Identity Theft Protection

- Comprehensive monitoring of personal information, online accounts, and social media for signs of identity theft.

- Dark Web monitoring to detect when personal information is exposed online.

- Automated removal of personal data from data broker sites, making it harder for identity thieves to access.

Privacy and Device Protection

- Password manager and automated password change features to secure online accounts and manage credentials across devices.

- WiFi security/VPN and antivirus protection to keep your devices safe while using public networks and protect them from malware.

$5 Million Identity Theft Insurance

Each adult member enrolled in the plan receives their own $5 million identity theft insurance policy to cover losses from identity theft, including stolen funds, attorney fees, lost wages, and more.

Family Safety (for Family Plans)

- Inclusive coverage for unlimited dependent minors and up to 10 additional adults, regardless of relationship or residence.

- Parental controls and cyberbullying protection to help safeguard children’s online activities.

- Child social security number monitoring and the ability to freeze child credit across all three credit bureaus.